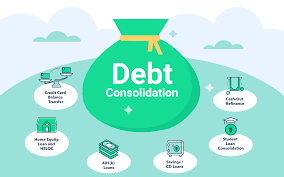

Managing multiple debts can be overwhelming and stressful. If you’re juggling credit cards, personal loans, or other forms of debt, it can feel like a never-ending cycle of monthly payments and varying interest rates. This is where loan consolidation comes into play. By consolidating your loans, you combine multiple debts into one, making it easier to manage your finances and potentially saving money in the process. In this article, we’ll explore the concept of loan consolidation, its benefits, and how it can simplify your debt repayment plan.

What is Loan Consolidation?

Loan consolidation involves combining multiple loans or debts into a single loan with one monthly payment. This could include a variety of debts such as personal loans, credit card balances, medical bills, or student loans. The goal of consolidation is to streamline your repayment process and make managing your finances more manageable.

There are two common ways to consolidate loans:

- Debt Consolidation Loan: This involves taking out a new loan to pay off your existing debts. You’re left with only one loan to repay, and often, the new loan may have a lower interest rate.

- Balance Transfer: For credit card debt, this method involves transferring balances from multiple cards to a new credit card with a lower interest rate or a 0% introductory APR offer for a certain period.

The Benefits of Loan Consolidation

Loan consolidation offers several benefits, including financial simplicity and potential savings. Here are the top advantages of consolidating your loans:

1. Simplified Monthly Payments

Instead of tracking multiple due dates and managing various payment amounts, loan consolidation combines everything into a single payment. This simplifies the repayment process, reducing the risk of missing a payment or paying late fees.

2. Lower Interest Rates

By consolidating your loans, you may qualify for a lower interest rate. If your credit has improved or you’re able to secure a loan with better terms, you can save money in the long run. A lower interest rate means more of your monthly payment goes toward the principal balance rather than the interest charges, helping you pay off the loan faster.

3. Potential for Lower Monthly Payments

In some cases, consolidating loans can result in a lower monthly payment. This happens when the repayment period of the consolidated loan is extended. However, while this can ease financial strain in the short term, keep in mind that extending the term of the loan could result in paying more interest over time.

4. Reduced Stress and Easier Financial Management

Consolidating loans into one payment helps reduce the mental burden of managing multiple debts. It’s much easier to stay on top of one payment, especially if the interest rates are lower. It can also help you maintain a good credit score by avoiding missed or late payments.

5. Access to Better Terms

When you consolidate your loans, you might have access to more favorable terms, such as a fixed interest rate, which means your monthly payments will remain consistent throughout the life of the loan. This makes budgeting easier and provides peace of mind.

How Loan Consolidation Works

Here’s how loan consolidation typically works:

- Evaluate Your Existing Debts: Before consolidating, take a close look at your outstanding loans. Calculate how much you owe in total, including interest rates and monthly payments. This will give you an idea of whether loan consolidation is a good option.

- Research Consolidation Options: There are various consolidation options available, including personal loans, balance transfers, or debt management programs. Compare the terms, interest rates, and fees to find the best fit for your financial situation.

- Apply for a Consolidation Loan: Once you’ve selected the best consolidation option, you’ll need to apply for the loan. Lenders typically look at your credit score, income, and debt-to-income ratio to determine if you qualify for the loan and the interest rate.

- Pay Off Your Existing Debts: Once your loan is approved, the lender will pay off your existing debts, and you’ll be left with only one consolidated loan to repay.

- Repay Your Consolidated Loan: Start making monthly payments on the new loan, which will now cover all of your previous debts. Make sure to stay on top of payments to avoid penalties and additional interest.

Who Should Consider Loan Consolidation?

Loan consolidation is not for everyone. It can be a helpful tool for those who:

- Struggle to manage multiple debts: If you’re finding it difficult to keep track of multiple due dates and loan payments, consolidation could help you gain control.

- Have high-interest debt: If you’re paying high interest rates on credit cards or personal loans, consolidation may allow you to secure a loan with a lower interest rate, reducing the overall cost of your debt.

- Want a more manageable monthly payment: Consolidation could help lower your monthly payments if you’re struggling to meet them, allowing you to free up money for other expenses.

However, it’s important to understand that loan consolidation may not be the best option for everyone. If you have significant debt or a poor credit history, the interest rates available to you may not offer significant savings. Also, consolidating federal student loans may result in the loss of certain borrower benefits such as loan forgiveness programs or income-driven repayment plans.

When Not to Consolidate Loans

Loan consolidation may not be the right choice if:

- You have high-interest credit card debt that you can pay off quickly without consolidating.

- You’re consolidating to avoid addressing underlying financial problems, such as overspending or poor budgeting.

- You have federal student loans that come with benefits such as deferment or income-driven repayment programs, which may not be available with consolidation.

Alternatives to Loan Consolidation

If loan consolidation doesn’t seem like the right fit for you, there are other options to manage debt:

- Debt Snowball Method: Pay off your smallest debt first, then move on to the next smallest debt, and so on. This method provides motivation as you knock out one debt at a time.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first. This method can save you more money in the long run.

- Debt Settlement: If you’re struggling with unmanageable debt, debt settlement allows you to negotiate with creditors to pay a lower amount than what you owe.

Conclusion

Loan consolidation is a powerful financial tool that can simplify your debt repayment process, lower interest rates, and make managing your finances easier. However, it’s important to carefully consider your options and assess whether it aligns with your long-term financial goals. If used wisely, loan consolidation can help you get back on track financially and reduce the burden of multiple debts. If you’re struggling with debt, take the time to explore consolidation options and see if it’s the right strategy to improve your financial situation.

Do you want to learn more about the consolidation process or explore other debt management strategies? Feel free to ask!