When it comes to protecting your assets and financial future, having the right insurance coverage is essential. While standard policies like home, auto, and life insurance provide necessary coverage, there may be times when these policies fall short. That’s where umbrella insurance comes in. Umbrella insurance is designed to provide additional liability coverage above and beyond your existing policies, offering extra protection in case you face a lawsuit or major claim. In this article, we’ll explore what umbrella insurance is, how it works, and how it can benefit you.

What Is Umbrella Insurance?

Umbrella insurance is a type of liability insurance that provides extra coverage beyond the limits of your existing home, auto, or boat insurance. It helps protect your assets in the event of a large claim or lawsuit that exceeds the coverage limits of your primary insurance policies. Essentially, umbrella insurance acts as a safety net, ensuring that you are financially protected in situations where your standard insurance policies may not provide enough coverage.

For example, if you are found liable for an accident in which someone is seriously injured and your auto insurance policy has a $300,000 liability limit, but the claim is for $1 million, your umbrella policy would cover the remaining $700,000.

How Does Umbrella Insurance Work?

Umbrella insurance kicks in after your primary insurance policy has reached its coverage limit. Let’s say you have an auto insurance policy with a $500,000 liability limit, but you’re involved in a severe car accident, and the total damages and medical costs amount to $1.5 million. In this case, your auto insurance would cover the first $500,000, and your umbrella insurance would cover the remaining $1 million, up to the limit of your umbrella policy.

It’s important to note that umbrella insurance only covers liability claims (such as bodily injury, property damage, or personal injury). It does not cover damage to your property, your own injuries, or losses due to intentional actions.

What Does Umbrella Insurance Cover?

Umbrella insurance provides broader coverage than what’s offered by your standard policies. Here are the main areas that umbrella insurance typically covers:

- Bodily Injury Liability

If someone is injured in an accident for which you are found liable, umbrella insurance helps cover medical expenses, lost wages, pain and suffering, and legal fees. For example, if you’re hosting a party and a guest is injured at your home, umbrella insurance would provide additional coverage if your homeowner’s insurance policy doesn’t cover the full amount of damages. - Property Damage Liability

If you accidentally damage someone else’s property—whether through a car accident, a fallen tree on your neighbor’s property, or damage to someone’s fence—umbrella insurance provides additional coverage for property damage. - Personal Injury

Umbrella insurance can also cover claims for defamation, slander, or libel. For instance, if you’re involved in a legal dispute over a statement you made that harms someone’s reputation, umbrella insurance could help pay for the costs of defending the lawsuit and any resulting settlements. - Legal Defense Costs

Umbrella insurance not only helps cover damages but also covers legal defense costs. Even if you’re not at fault, defending yourself in court can be expensive. Umbrella insurance covers these legal fees, helping protect your finances in case of a lawsuit. - Worldwide Coverage

Unlike some other insurance policies, umbrella insurance provides worldwide coverage, meaning you’re protected even when traveling abroad.

Why Should You Consider Umbrella Insurance?

While umbrella insurance may not be necessary for everyone, there are several reasons why it could be a valuable investment for you. Here’s why you should consider adding umbrella insurance to your coverage:

1. Higher Risk of Lawsuits

If you have significant assets (such as a home, savings, or investments), you may be at higher risk of being sued. In the event of an accident or mishap that leads to serious injury or property damage, a lawsuit could exceed the liability limits of your existing insurance policies. Umbrella insurance provides an extra layer of protection to ensure your assets aren’t at risk.

2. Peace of Mind

Umbrella insurance offers peace of mind, knowing that you have extra coverage in place if an unexpected event occurs. Whether it’s an automobile accident, a fall at your home, or an online defamation claim, umbrella insurance provides an added layer of security for your financial well-being.

3. Affordable Coverage

Despite offering extensive coverage, umbrella insurance is relatively affordable. The cost of umbrella insurance is typically much lower than increasing the liability limits on your primary policies. For just a few hundred dollars a year, you could gain millions of dollars in extra coverage, making it a cost-effective way to protect your finances.

4. Broad Coverage Beyond Primary Policies

Umbrella insurance can cover situations not typically addressed by standard auto or home insurance policies, such as certain personal injury claims (e.g., defamation). If you’re involved in a lawsuit that isn’t related to property damage or bodily injury, umbrella insurance might still provide coverage.

5. Protection for Your Family

Umbrella insurance isn’t just for you; it also covers your family members. If your children are involved in a lawsuit (for example, if they accidentally cause property damage or injury to someone else), your umbrella policy can help cover those costs.

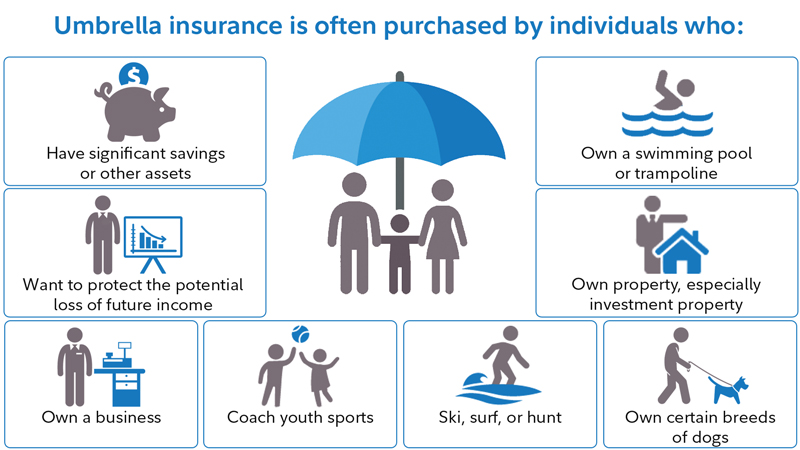

Who Should Consider Umbrella Insurance?

Umbrella insurance may be a good option if:

- You own a home, have a substantial savings or investments, or have other valuable assets.

- You engage in activities that put you at higher risk for liability, such as owning a pool, hosting parties, or driving frequently.

- You are involved in a profession or business that could expose you to lawsuits.

- You want to ensure that you and your family are financially protected in case of a significant claim or lawsuit.

How Much Umbrella Insurance Do You Need?

The amount of umbrella insurance you need depends on your assets, lifestyle, and risk factors. Most experts recommend purchasing a policy with a coverage limit of at least $1 million, but you can choose a higher limit depending on your financial situation. When determining how much coverage you need, consider the following:

- The value of your home and other assets.

- Your income and how much you could potentially lose in a lawsuit.

- The types of activities you engage in that could increase your liability risk (e.g., owning a pool, having teenage drivers, or hosting large gatherings).

Also Read : What Is Health Insurance And Why Do You Need It?

Conclusion

Umbrella insurance is a smart way to protect your assets and provide additional liability coverage that goes beyond your existing policies. Whether you’re concerned about the financial risks of a lawsuit or simply want to add an extra layer of security for your family’s future, umbrella insurance offers peace of mind at an affordable price. Consider reviewing your current coverage and discussing umbrella insurance with your agent to see if it’s the right solution for you.